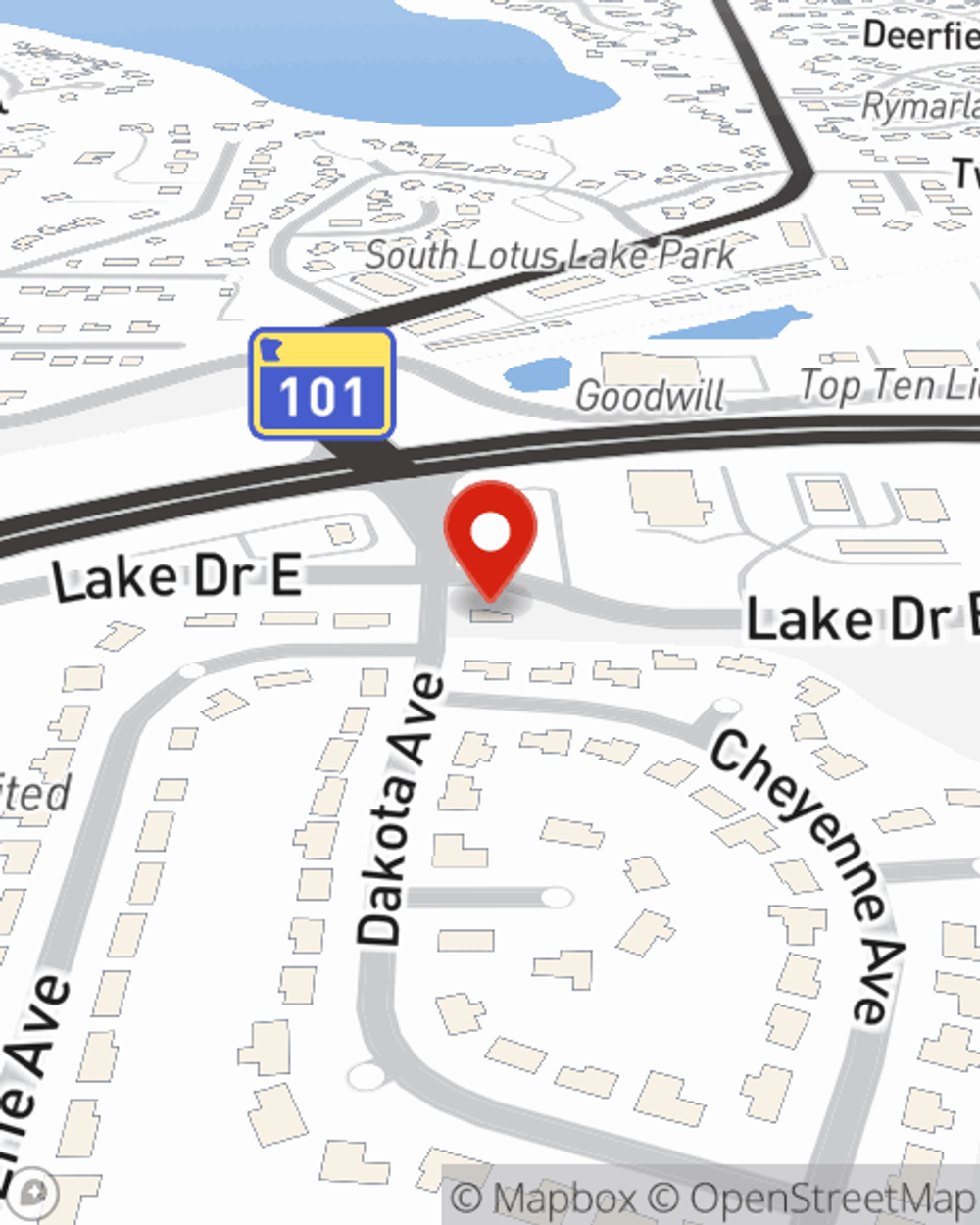

Business Insurance in and around Chanhassen

One of the top small business insurance companies in Chanhassen, and beyond.

Helping insure businesses can be the neighborly thing to do

State Farm Understands Small Businesses.

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide outstanding insurance for your business. Your policy can include options such as extra liability coverage, a surety or fidelity bond, and worker's compensation for your employees.

One of the top small business insurance companies in Chanhassen, and beyond.

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

Your company is one of a kind. It's where you make your living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just earning a paycheck or a store. Your business is part of who you are. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers a variety of occupations like a drywall installer. State Farm agent Jeremy Senn is ready to help review coverages that fit your business needs. Whether you are a drywall installer, an optometrist or a piano tuner, or your business is a hobby shop, a shoe store or a window treatment store. Whatever your do, your State Farm agent can help because our agents are business owners too! Jeremy Senn understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Call Jeremy Senn today, and let's get down to business.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Jeremy Senn

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.